Accounting and Business

Level 4 & 5 OTHM Diploma in Accounting and Business

Ofqual Regulated

Level 4 Diploma in Accounting and Business – 610/0792/4

Level 5 Diploma in Business Management – 610/1527/1

Start Date: Anytime

Location: Online

Study Pace: Flexible — up to 5 years to complete

Qualifications:

Level 4 OTHM Diploma (120 credits)

Level 5 OTHM Diploma (120 credits)

Combined Level 4 & 5 OTHM Diploma (240 credits)

Assessment: Online written assignments

Includes: 1-to-1 tutor support, all course materials, and more

Course Overview

Dream of managing finances for prestigious companies or overseeing budgets for major global projects? From financial planning and analysis to auditing and corporate finance, our online Accounting and Business course equips learners with the skills and knowledge required to succeed in the financial sector.

Accredited by OTHM and recognised by leading financial organisations, this programme covers core areas such as:

Financial reporting and accounting principles

Budgeting and investment management

Risk assessment and compliance

Strategic financial planning

Corporate finance and auditing

The course provides learners with both practical and theoretical expertise, preparing them for a wide range of high-level careers in a competitive global market.

Progression

Graduates of the Level 4 & 5 OTHM Diploma in Accounting and Business can pursue advanced career opportunities, including:

Financial Analyst – evaluating financial data to guide business decisions

Management Accountant – overseeing budgeting, forecasting, and internal reporting

Auditor – assessing financial statements and compliance

Corporate Finance Specialist – managing investments, mergers, and corporate funding strategies

Financial Planner/Advisor – providing investment and wealth management services

Business Consultant – supporting organisational strategy and financial performance

Learners may also progress to undergraduate degrees or higher-level professional accounting and finance certifications, creating pathways to senior management and leadership positions.

Course Structure

The Level 4 & 5 OTHM Diploma in Accounting and Business is delivered fully online and consists of modules at each level, with 40 guided learning hours per module and additional optional study materials.

Level 4 Modules

Financial Accounting

Management Accounting

Business Economics

Business Law

Principles of Management

Professional Development

Level 5 Modules

Advanced Financial Management

Corporate Governance

Strategic Management

Auditing and Assurance

Business Research Methods

Leadership and Change Management

Each module is assessed via a written assignment (approx. 2,000–3,000 words), with 1-to-1 tutor support available throughout the course.

This structure provides a clear pathway from foundational accounting and business principles to advanced strategic and financial management skills, preparing learners for senior roles or further academic study.

How It Works

How It Works

The Level 4/5 Accounting and Business online course consists of 10 modules and 6 written assignments at each level. Assignments are approximately 2,000–3,000 words each, and students receive full support via the ‘Tutor’ section of the learning platform.

Course Modules

Level 4 Diploma in Accounting and Business – Modules

Academic Writing and Research Skills (20 credits)

Build strong research and writing skills for academic and professional success.Business and the Economic Environment (20 credits)

Understand how economic factors and policies influence business decisions and performance.Principles of Financial Accounting (20 credits)

Learn the basics of financial reporting, including balance sheets, income statements, and cash flow.Quantitative Methods in a Business Context (20 credits)

Use numerical data and statistical tools to support business planning and decision-making.Management Accounting (20 credits)

Explore how accounting information is used internally to control costs and improve performance.Leading and Managing Teams (20 credits)

Discover effective strategies for leading, motivating, and managing teams in the workplace.

Assignment Unit Titles – Level 4:

Academic Writing and Research Skills

Business and the Economic Environment

Principles of Financial Accounting

Quantitative Methods in a Business Context

Management Accounting

Leading and Managing Teams

More information on Level 4 units is available here.

Level 5 Diploma in Business Management – Modules

Principles and Concepts of Strategy (20 credits)

Explore how businesses plan and implement strategies to stay competitive and grow.The Management of Human Resources (20 credits)

Learn how to recruit, manage, and develop people effectively in the workplace.Marketing for Managers (20 credits)

Understand key marketing tools and how managers use them to achieve business goals.Business Law for Managers (20 credits)

Gain insight into the legal responsibilities and rights affecting business operations.Management Accounting and Decision Making (20 credits)

Use financial information to support informed business decisions and planning.Business Start-up: Conception to Market (20 credits)

Learn how to turn a business idea into a real venture, from planning to launch.

Assignment Unit Titles – Level 5:

Principles and Concepts of Strategy

The Management of Human Resources

Marketing for Managers

Business Law for Managers

Management Accounting and Decision Making

Business Start-up: Conception to Market

More information on Level 5 units is available here.

Entry Requirements

Entry requirements

Am I eligible for this online business course ?

To enrol in our Level 4 Diploma in Business Management course, you must be at least 18 years old and have a full secondary education, meaning you must have a minimum of 2 A-levels or equivalent.

If you don’t have 2 A-levels or the equivalent, such as NVQ Level 3, you may also be able to enrol based on your work experience. To find out more, talk to one of our helpful team members at:

+40 743 543 039

To enrol on the Level 5 diploma in Business Management course, you must have completed the OTHM Level 4 Diploma in Business Management.

Cost & Payments

Cost & payments

- Level 4 & 5: £3,500

- Level 4: £2,900

- Level 5: £2,900

Students can make payment using one of the following methods:

- Credit or debit card

- Bank transfer

- PayPal

- Level 4 & 5: £3,500

Career Progression

Career Progression

Studying our online Accounting and Business course opens a wide range of career opportunities across multiple industries. Some of the primary career paths include:

Public Accounting

Auditor – Conduct financial audits to ensure accuracy and compliance with regulations

Tax Advisor – Prepare and file tax returns and provide tax planning and advice to individuals and businesses

Corporate Accounting

Financial Accountant – Prepare financial statements, manage ledgers, and ensure compliance with accounting standards

Management Accountant – Focus on internal financial analysis, budgeting, and cost management to support business decision-making

Government and Nonprofit Accounting

Government Accountant – Manage public funds, audit government agencies, and ensure financial compliance

Nonprofit Accountant – Handle financial reporting, budgeting, and grant management for nonprofit organisations

Specialised Accounting Roles

Forensic Accountant – Investigate financial fraud and disputes, often working with law enforcement

Environmental Accountant – Analyse the financial impact of environmental regulations and sustainability initiatives

Financial Services

Financial Analyst – Analyse financial data, develop investment strategies, and provide recommendations to businesses and investors

Credit Analyst – Assess the creditworthiness of individuals and businesses to support lending decisions

Budget Analyst – Develop and manage budgets, forecast financial needs, and analyse spending patterns

Accounting and business skills are highly versatile and in demand, providing career opportunities across virtually every sector of the economy.

University Options

University Progression

Once you’ve completed your online Level 4 & 5 Accounting and Business course you have the opportunity to complete a third-year Accounting and Business degree programme, known as a ‘BA top up’, from a wide range of UK universities.

Students can apply to any university offering the BA top up and you can choose to study for your degree either online or in-person on campus.

If you decide to top up to a full undergraduate degree through an accredited UK university, the costs are listed below.

Coventry University

Business Management and Leadership BA (Hons)– London Campus – £10,000

Business Management and Leadership BA (Hons)– Coventry Campus- £10,000

Northampton University

BSc (Hons) in International Accounting -£9,250

University of Derby

BSc (Hons) Business and Management– £5,200

Westcliff University

Business Administration – £11,655 (online) / £15,600 (on campus)

University of Hertfordshire

BA (Hons) Business Administration – £6,400

University of Central Lancashire (UCLAN)

BA (Hons) Business Management – £9,240

University of Hertfordshire

BA (Hons) Business Administration (top-up) (Online)

Edinburgh Napier University

BA in Business Management – £4,600

BA in Business and Enterprise – £4,600

BA in Sales Management – £4,600

University of Sunderland – On Campus

BA (Hons) Business and Management – £9,250

University of Bolton

BSc Honours Business with Finance top-up

University of Cumbria

BA (Hons) Global Business Management – ON CAMPUS– £9,250 UK/ £13,250 International

BA (Hons) International Business Management – ON CAMPUS– £9,250 UK/ £13,250 International

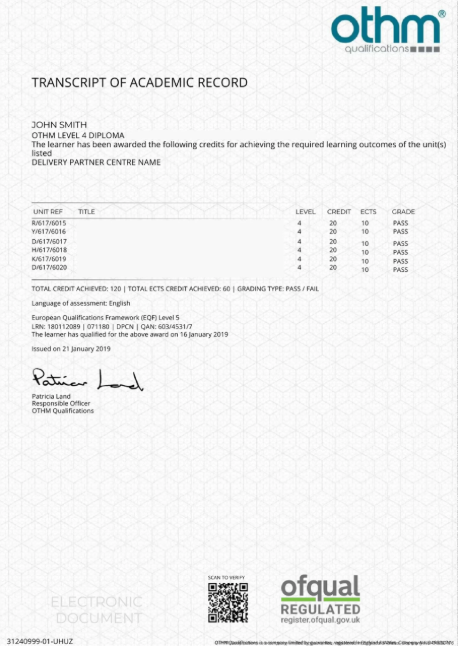

Certificate Sample

Sample Certificates

Sample Certificate

Level 4 Diploma Sample Certificate and Transcript